Last updated on March-2024 by Nilotpal Ray, PMP

Types of Contracts in Procurement Management

Types of procurement contracts have always been one of the most confusing topics among the students who are preparing for the PMP Exam and CAPM Exam.

In this article, we’ll be learning about different types of contracts such as:

- Firm Fixed Price (FFP)

- Fixed Price with Incentive Fee (FPIF)

- Fixed Price with Economic Price Adjustments (FPEPA)

- Cost Plus Percentage Cost (CPPC)

- Cost Plus Fixed Fee (CPFF)

- Cost Plus Award Fee (CPAF)

- Cost Plus Incentive Fee (CPIF)

- Time and Material Contract (T&M), and

- Indefinite Delivery Indefinite Quantity (IDIQ) contracts

If these terms seem confusing to you, or if you are struggling to understand the key characteristics of these contracts, or if you are facing the problem to understand their significance, uses, and meaning….do make sure you read through the article till the very end.

By the end of this article, you will be getting a better understanding of these contracts, which will result in better preparation for your upcoming PMP and CAPM Examination.

I have referred to both the PMBOK 6th edition and PMBOK 7th Edition for this article in the context of the recent changes & upgrades to the PMP and CAPM Exam in 2023. You can also find a detailed comparison between PMBOK 6th edition and PMBOK 7th Edition here

TYPES OF PROCUREMENT CONTRACTS – 3 MAJOR CATEGORIES:

In Procurement Management, contracts are on 3 main categories:

- – Firm Fixed Price Contract or FFP Contract

- – Cost Reimbursable Contract or CR Contract

- – Time and Material Contract or T&M Contract

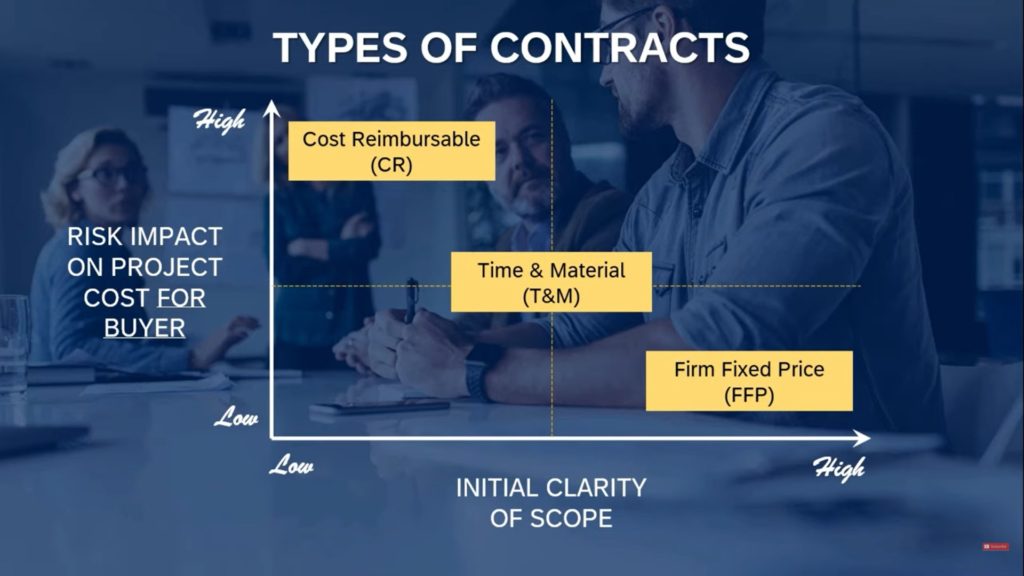

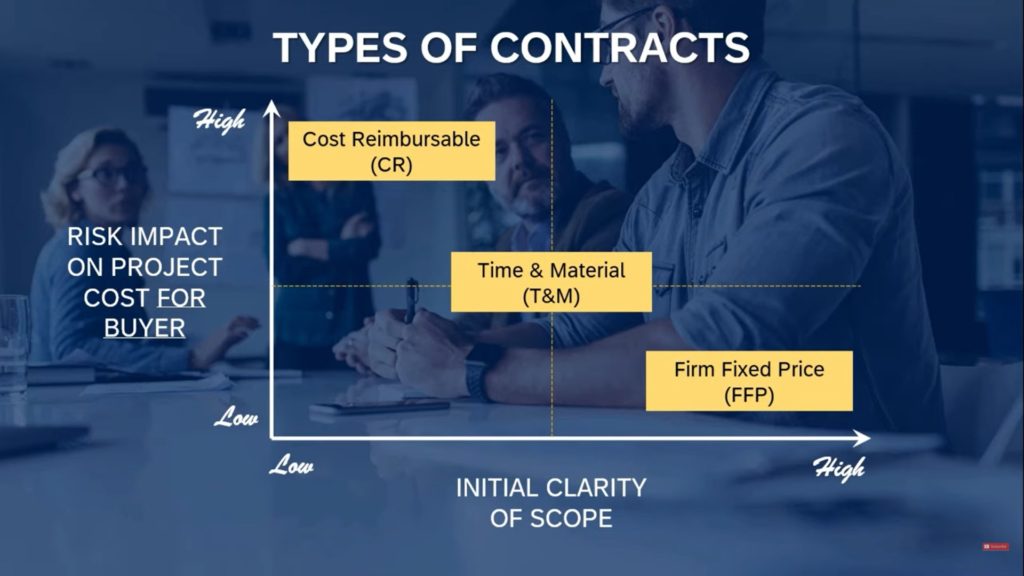

To understand the definition of these contracts the following parameters (X and Y axis in the figure above) should always be kept in mind:

1- Initial clarity of Scope in Project- It signifies how clear and well defined the scope of the project is at its initiation phase. This is irrespective of the type of project you are dealing with be it Agile, Hybrid or Predictive.

2- Risk impact of the cost of the project on the buyer- For this, either you will be evaluating it from the buyer’s perspective or for the project itself. So, keep in mind that while answering questions on the procurement management topic, you always have to assess the scenario with yourself as the project manager on the buyer’s side, unless stated otherwise!

Now let’s understand the 3 main categories of Procurement Contracts:

FIRM FIXED-PRICE CONTRACT in Procurement Management

Firm fixed-price (FFP) contracts specifically refer to a type or variety of fixed-price contracts where the buyer or purchaser pays/agrees to pay the seller or provider a fixed amount for the aligned scope of works. This set amount will not waiver or vary under any circumstances whatsoever, such as in situations where unexpected costs arise suddenly and the provider (seller) may need to use additional resources. In this type of contract, the buyers’ risk is very low but seller’s risk is very high.

For example: If you order a book worth $20 from Amazon, it’s kind of a FFP contact between you & Amazon. If some unforeseen issue happens in Amazon’s supply chain and the all-in delivery cost of the book which Amazon initially estimated to be at $12 now becomes $50, then still Amazon has to bear the additional cost of $30 ($50 – $20) and you as the buyer will not have to bear any portion of the loss.

ADVANTAGES OF FFP CONTRACT

- The high clarity of scope upfront makes it easier for both the parties to align on the end-state of deliverables

- The buyer does not bear any cost or schedule risk

- Initial project costs may be inflated in an FFP contract. This is due to sellers building up lots of cost buffers/margins due to fear of unknowns at the beginning of the project

- If for some reason the project gets delayed with issues at the supplier’s end, and the supplier sees that costs are irrecoverable, then they may start to sacrifice the safety and quality standards of the project to maintain their profit margins

COST REIMBURSABLE CONTRACTS in Procurement Management

Cost Reimbursable (CR) Contracts are the type of contracts where the buyer agrees to pay the seller as per the actuals of resources (time, material, admin fees, equipment, overheads etc.) spent/used by the seller towards completion of an agreed scope plus an additional fee on top which represents seller’s profit. CR contracts are generally used when the scope of works are not very clear at the beginning and there is a high probability of the scope getting altered during the execution of the project. CR contracts are often found in Agile and Scrum Projects.

For example: If you are hiring a video editor for your YouTube channel on an hourly basis with an open-ended scope of editing video footage not being fully sure of how many hh:mm:ss of video needs to edited/week, then this is a type of cost-reimbursable contract. Another example where CR contracts could be used is in the development of new applications for android and IOS where the scope is vague and the functionalities of the application will require lots of user testing and analysis.

ADVANTAGES OF COST-REIMBURSABLE CONTRACT

- CR contracts prevent dummy billing. This means, the seller cannot bill the buyer for something that’s not done as the buyer verifies every invoice and every hour of work before releasing payment

- CR contacts offer a lot of flexibility with R&D type projects where the scope & duration of work is quite abstract

- CR protects sellers against any ongoing/unforeseen cost risk.

- The clarity of the scope & accountability of adhering to timelines is very low all along the execution of a CR contract. This leaves room for a lot of misinterpretation and inefficiency. For example, a dishonest seller can bill 5 hours for a 2-hour job mentioning that the scope had not been explained to them clearly at the onset

- Cost risk for buyers is very high in CR contracts and there are chances of major cost overrun in projects with CR contracts, if not managed diligently

TIME AND MATERIAL (T&M) CONTRACT in Procurement Management

Time and Material (T&M) Contract in Procurement Management is a type of contract which poses an equal risk for the buyer and the seller. In this case, the buyer pays for the ‘materials’ while the seller pays for the ‘time’ of his resources (labor, real-estate, equipment hiring etc.) for the completion of a particular scope of work. As a buyer, you can always set an upper limit on ‘time’ and ‘materials’ to ensure better control on costs.

For example: If Rayson Construction is hiring Apollo Builders to develop a housing estate where Rayson pays for the materials (steel, cement, building materials) while Apollo pays for the time (labor time, workshop time, land-mover equipment hiring etc.) then this would be a classic example of T&M contract.

Risk for Buyers in Time and Material Contract-

- Very limited control on materials cost and its scope of billing. For example, steel prices may rise in the country suddenly and the buyer has to bear the cost

- Limited control on man hours/equipment hours for billed by the seller

Risk for Sellers in Time and Material Contract-

- The upper limit of the cost of materials & man-hours is decided at the beginning. In case of a major overrun of labor costs, the seller has to bear the loss

FPIF, FPEPA, CPPC, CPFF, CPIF, CPAF and IDIQ Contracts in Procurement Management

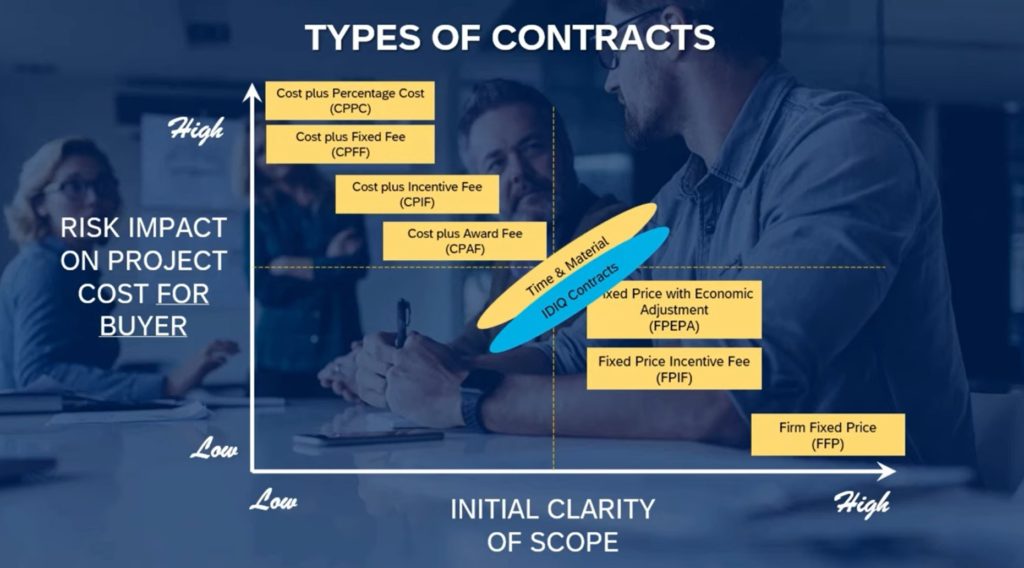

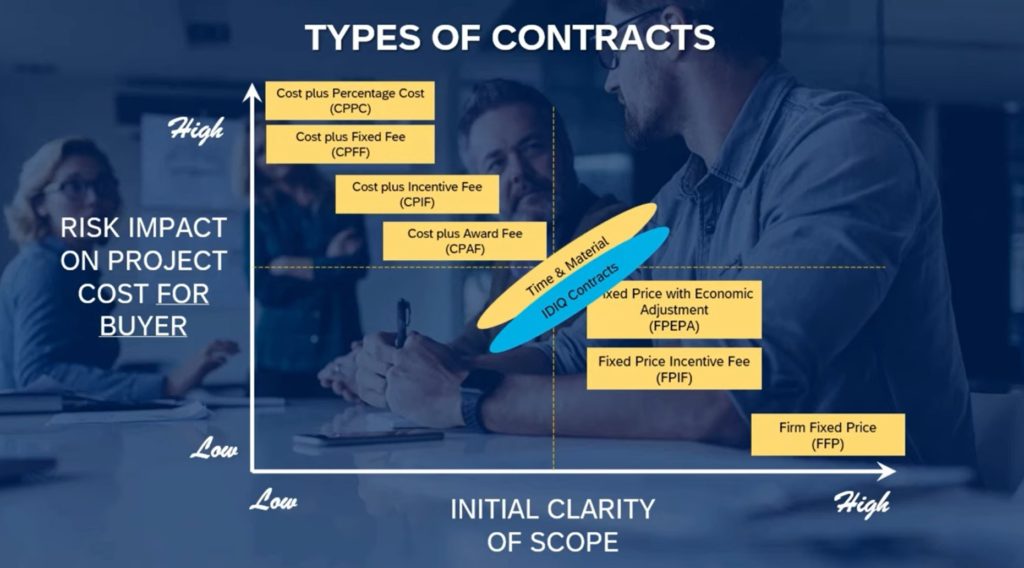

In the context of the X-Y axis chart as depicted below, please find the details of other types of contracts as used in procurement management in the next section:

Firm Fixed Price (FFP) Contract:

This is the best contract type when someone knows exactly what the scope of work is. Also known as a lump sum contract, this contract is the best way to keep costs low when you can predict the scope. For instance, if an organization needs services from a vendor, and the scope is clearly defined, the contract makes sure the organization only pays a specified amount for the required work. Here the seller must complete the job or supply the product or service within an agreed amount of time and at a set price.

Fixed Price Incentive Fee (FPIF) Contract:

Identical to a FFP contract except that the seller may receive an additional monetary incentive if they perform well – for example, completing the project ahead of schedule. Under FPIF contracts, a price ceiling is set, and all costs above the price ceiling are the responsibility of the seller.

Fixed Price with Economic Price Adjustments (FPEPA) Contract:

This contract type is most often used when the project is expected to take a long time, to protect the seller from inflation that may occur over the duration. For instance, this type of contract allows for a clause that gives the contractor a certain percentage increase after a predetermined amount of time. Generally, organizations based on the percentage on the consumer price index or the CPI. Note that this type of contract does not come with any ceiling of price adjustments. So, if the project is delayed for quite some time and the rate of inflation rises during that period, the buyer usually suffers a huge loss. For this reason, FPEPA contract poses a higher cost risk than an FPIF contract for the buyer.

Cost Plus Percentage Cost (CPPC) Contract:

This type of contract pays all of the seller’s costs, along with a percentage of the costs as profit. However, with this type of contract, there is an incentive for sellers to increase their actual costs so they get more profit. Hence, these type of CR contracts offer the most buyer risk.

Cost Plus Fixed Fee (CPFF) Contract:

Here the buyer pays the seller for all incurred costs plus a pre-negotiated fee, which is paid regardless of the seller’s performance. This amount does not change unless the project scope changes. Agile projects often use these types of contracts due to the very nature of flexibility that cost reimbursable contracts offer. It’s better than CPPC contracts since the ‘fixed’ nature of the fee reduces the incentive for the seller to artificially inflate the cost. Moreover, the buyer here has the control on how much ‘fixed fee’ should be agreed upon. Hence it’s better than CPPC.

Cost Plus Incentive Fee (CPIF) Contract:

Here, the seller is reimbursed for all allowable costs for performing the contract work and receives a predetermined incentive fee based on achieving certain performance objectives as set forth in the contract (KPIs may include over-delivering success criteria in schedule, quality etc). In CPIF contracts, if the final costs are less or greater than the original estimated costs, then both the buyer and seller share costs from the departures based upon a pre-negotiated cost-sharing formula, for example, an 80/20 split over/under target costs based on the actual performance of the seller. Hence, the risk is somewhat shared between the buyer & the seller. This is the most optimized type of CR contracts.

Cost Plus Award Fee (CPAF) Contract:

With this type of CR contract, the incentive fee is based on how well the buyer believes the seller met the performance objectives. Because this is subjective, it is not open to change, so the language must be clear. Use language that states the contractor will receive an award of up to a certain dollar amount if they either meet or exceed the job requirements that are outlined in the terms. Hence, this contract is the ‘most buyer safe’ one in the types of CR contracts.

Time & Material Contract (T&M):

The time and materials contract (T&M contract) is most often used when the seller provides labor and material. The risk is fairly even between both parties (buyer & seller). This contract is used to hire outside vendors and experts and lists the experience and qualifications desired (Eg. Hiring an external audit firm or consultancy firm). Sellers submit an hourly rate for their bids. In this type of contract, it’s crucial to set a limit or you could find the project over budget. T&M contracts are often used to hire outside support when a precise statement of work cannot be quickly prescribed.

Indefinite Delivery Indefinite Quantity (IDIQ) Contracts:

This type of contract is introduced for the first time within PMI Standards in PMBOK 7th edition (not to be found in PMBOK 6th Edition). Indefinite Delivery Indefinite Quantity (IDIQ) contracts provide for an indefinite quantity of services for a fixed time. They are used when the buyer can’t determine, above a specified minimum, the precise quantities of supplies or services that will be required during the contract period. IDIQs help streamline the contract process and speed service delivery. A classic example of IDIQ contract is the car breakdown services coverage provided by companies such as AA & RAC in the United Kingdom. These companies typically cover you for unlimited breakdown callouts for 1 year for a fixed yearly cost for any issue you may face with your car on the roads of UK during that timeframe.

As my concluding remarks, I would like to highlight some points to remember that you should always keep in your mind while answering questions on Procurement Management in PMP or CAPM examination:

If you want have a video based tutorial on the Types of Contract in Procurement Management, check out my video on YouTube below:

Hope you enjoyed reading the article. If you are preparing for the PMP Exam, also do check my articles on PMP Exam Eligibility Requirements and PMP Exam Passing Score. If you are preparing for your PMP Exam, don’t forget to check out my Udemy Courses and Live PMP Masterclass Sessions as below:

The last one is the best if you are struggling to learn EVM during your PMP and CAPM preparation.

Cheers and I will talk to you soon!

Ray